Alliance* Lenders came to us having never run PPC ads before. Marketing and sales were set up in a haphazard fashion with traffic being directed to the website but not tracked properly. They hired us to fulfill two goals –

1) A self-sufficient lead pipeline (10+ monthly leads)

2) Low CPL ($30 or lesser)

The major challenges we faced were:

Absence of Lead Magnet – Behind every successful lead funnel is a great lead magnet. The client did not have any opt-in, deal or promise that could be used as an engaging lead magnet.

Limited Budget – When compared with current players in the game, the client had a relatively lower budget. While others had an estimated daily budget of $150, our client had $50. (We usually use SpyFu in the research stage to set our expectations!) Combine this with the goal of low CPL and it presents a real challenge.

Lack of Data – Having not run any ads before, Alliance had zero data to work with. While this can be both a good and bad thing, having data available before starting is a great way of knowing what not to do. In this case, we were starting from scratch and paving the way.

Research – When in doubt, research. We started from an extensive keyword and competitor research. We use Google Ads planner for keyword & ad copy research. SpyFu’s competitor research showed us a common lead magnet that seemed to be doing well for others: a mortgage calculator.

Exact Match Keywords – Our past research and experimentation has shown that exact match keywords yield lower CPL and higher conversions than other match types. It might take longer to perform but in the long run, this is the better option. So we opted to create ad groups focusing on the lead magnet and populate them with more exact match keywords than BMMs and Phrase Matches.

Of course, as search terms came in, we modified these to perform better. Weekly optimizations focused more on adding exact match keywords to these ad groups to perform better.

Conversion Tracking – We pride ourselves on high-quality, converting landing pages. In this case, since we needed to park a mortgage calculator on the LP, conversion tracking had to be seamless. We integrated Unbounce with GoHighLevel to create a lead funnel trackable at every stage. To add to Adwords’ reporting, Google Analytics was linked with Unbounce to monitor every step. This helps monitor where, if, people are falling off!

Consistent Reporting – All efforts are useful only if the client’s goals are met! To close the loop we implemented monthly reporting with weekly check-ins for the first month after launch.

We followed the steps below to launch the campaign:

Keyword Research

Ad Copy Writing

Competitor Research

Campaign Build

Review & Launch

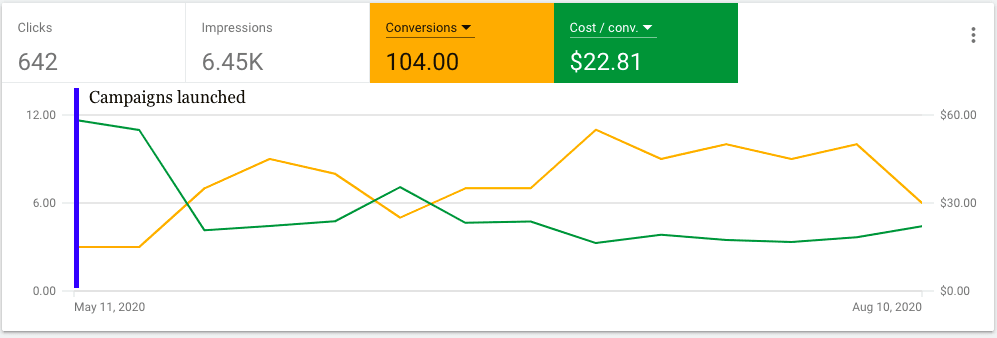

Our first campaign was enabled on the 8th of May.

Total Leads – 104 (with an average of 9 leads weekly)

CPL – $22 ($8 less than desired CPL of $30)

Impressions – 6,450

CTR – 9.78% (higher than industry average of 5%)

Cost – $2,500

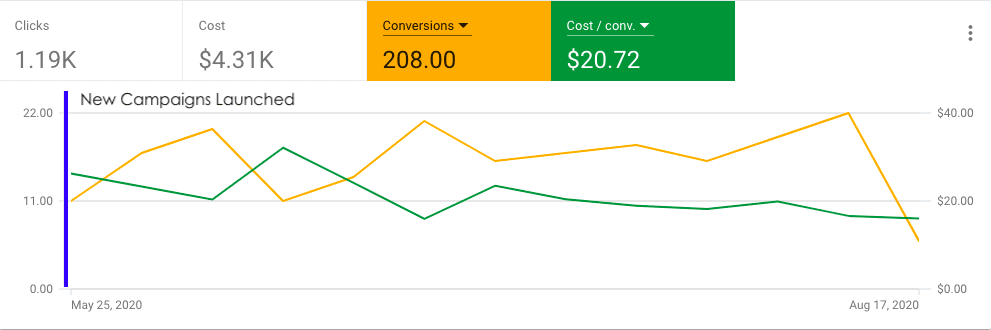

The client then added a location and two new campaigns with us!

For new campaigns:

Total Leads – 104 (an average of 10 leads weekly)

CPL – $22 ($8 less than desired CPL of $30)

Impressions – 5,894

CTR – 10.62% (higher than industry average of 5%)

Cost – $2,567

Out of the top 10 performing keywords, 6 are Exact Match Keywords. 50% of the total leads are from Exact Match alone with the CPL being $20. Compared to a CPL of $24 for BMM & $40 for Phrase Match, we seemed to have made the right call.

P.S – We are now in conversation with the client to increase the daily budget to $150 for all three campaigns!

*Disclaimer – to protect the client’s interests, the names of companies and people have been changed